2021-10-24 »

SimSWE 4: Wants, needs, and chasm-crossing

Let's talk about bug/feature tradeoffs.

Anyone who knows me has probably already heard me rant about Crossing the Chasm, my most favourite business book of all time. I love its simple explanation of market segmentation and why the life cycle of a tech startup so often goes the way it does. Reading that book is what taught me that business success is not just a result of luck or hard work. Strategy matters too.

As our company prepares for our chasm-crossing phase, I've been thinking about the math behind why chasm-crossing works and why our metrics plots (doesn't every startup do their key business metrics in R?) look the way they do, and I realized that chasm-crossing strategy must have a simple mathematical basis behind it. I bet I could math this.

And so, our simulated software engineering (SWE) team is back!

In previous episodes of SimSWE, we learned it's objectively good to be short-term decisive even if you're wrong and to avoid multitasking. Later, I expanded on all that, plus more, in my epic treatise on software scheduling. And then, as a bonus, our simulated SWEs went on to buy homes and distort prices in the California housing market.

This time, I want to explore the chasm-crossing process and, while we're here, answer the unanswerable question: what's a bug and what's a feature?

Nobody can agree on what they mean. When does "lack of a feature" become a bug? When a key customer demands it? When the project manager declares a code freeze but you still want to merge your almost-finished pull request? When it's Really Really Important that you launch at a particular conference?

The answer is, users don't care what you call it. Let's reformulate the question.

We need to make a distinction between needs and wants.

Back when I lived in New York, I took some fiction writing classes. One thing I learned is there is a specific recipe for "interesting" characters in a story, as follows: understand how characters' needs differ from their wants. It's rare that the two are the same. And that way lies drama.

So it is with customers. I want a browser that doesn't suck all my RAM and drain my battery. But I need a browser that works on every website and minimizes malware infections, so I use Chrome.

I want a scripting language that isn't filled with decades-old quoting idiosyncracies, but I need a scripting language that works everywhere, so I mostly use POSIX sh.

Some people call needs "table stakes." You must be this tall to ride the roller coaster, no exceptions. If you are not this tall, you cannot ride the roller coaster. Whether you want to ride the roller coaster is an orthogonal question related to your personal preferences.

Needs are AND. Wants are OR. A product must satisfy all your needs. It can get away with satisfying only one want, if you want it badly enough.

Needs are roadblocks to your product's adoption. (I previously wrote about roadblock analysis.)

A want is a reason to use some new software. A need is a reason you can't.

About 20 years ago(!), Joel on Software wrote about the 80/20 myth:

80% of the people use 20% of the features. So you convince yourself that you only need to implement 20% of the features, and you can still sell 80% as many copies. Unfortunately, it’s never the same 20%.

– Joel Spolsky

And yet, if you're starting a new project, you can't exactly do 100% of the features people want, all at once. What can you do instead?

Market segments, use cases, and needs

The best (and thankfully becoming common) advice to startups nowadays is to really nail just one use case at first. Pick a want, find people who want it, figure out what those people have in common, call it a market segment, solve the needs of the people in that segment, repeat.

This is all harder than it sounds, mostly because of your own human psychology. But it all lends itself well to rapid iteration, which is why our earlier SimSWE tips to be decisive and to avoid multitasking are right.

Getting back to Crossing the Chasm, the most essential advice in the book - and the hardest to follow - is to focus on your chosen market segment and ignore all requests from outside that segment. Pick one want. Fulfill all the needs.

Let's make a simulation to show what happens if you do or don't. And if we're lucky, the simulation will give us some insight into why that's such good advice.

Simulating wants and needs

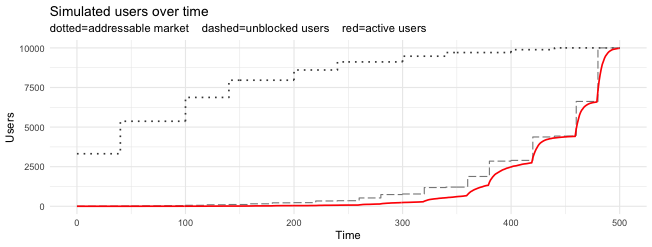

The plot below simulates a market that with 10,000 potential users, 10 potential wants, and 15 potential needs. Each user has a varying number of wants (averaging 3 each) and needs (averaging 5 each).

For a user to be interested in our product, it's sufficient for our product to fulfill any of their wants. On the other hand, for a user to actually adopt the product, they need to be interested, and we need to fulfill all their needs.

Side note: we can think of a "Minimum Viable Product" (MVP) as a product that fulfills one want, but none of the needs. There will be some tiny number of users who have no special needs and could actually use it. But a much larger group might want to use it. The MVP gives you a context for discussion with that larger group.

Before we get to all that deliberate activity, though, here's an example run of the simulator, with random-ish sequencing of wants and needs.

The dim dotted line is the Total Addressable Market (TAM). Every time you implement a want, the TAM goes up. Fun! This is what venture capitalist dreams are made of. All the users in the TAM are "interested" in your product, even if they aren't able to use it yet.

The dashed line is the "unblocked" users. These are users who are in the TAM and whose needs you've entirely filled. They legitimately could buy your product and be happy with it. Assuming they hear about you, go through the trial and sales process, etc. This is the maximum number of users you could have with your current product.

Finally, the red line is the number of users you actually have at any given time. It takes into effect marketing, word-of-mouth, and adoption delays.

Commentary

I'm already excited about this simulation because it shows how adoption curves "really look" in real life. In particular, you can see the telltale signs of a "real" adoption curve:

-

Exponentially growing uptake at first, which slows down as you saturate the market (ie. an "S-curve" shape).

-

When you look more closely, the big S-curve is made up of a bunch of smaller S-curves. Each time we fulfill a need, some group of users becomes unblocked, and we can move toward saturating an ever-bigger market.

Observe also that the jumps in the dotted line (fulfilled wants) are big at first, and smaller each time. That's because each user has an average of three wants, and you only need to satisfy one of them. Because of overlapping wants, the second want is split between new users and users you already have. Each successive want has a greater and greater overlap with your already-interested users, and thus less and less effect.

(Alas, this gives a good mathematical rationale for why "mature" products stop improving. Yes, there are all sorts of additional things your audience might want. But if adding them doesn't increase your TAM, it's strategically questionable whether you should bother. Bring on the continuous improvement debate.)

(On the other hand, this simulation is somewhat unrealistic because of the pre-defined market size of only 10,000 participants. If, instead of fulfilling more wants for your existing market segment, you add a new market segment, those new wants might have a bigger impact and your "big" S-curve might get a newer, bigger S-curve added to it. This is small consolation to your existing users who would like some more stuff added that they care about, though.)

In contrast, the jumps in the dashed line (needs fulfilled) start small and get bigger. This also makes sense intuitively: since users can't adopt the product until all their needs are met, and the typical user has 5 needs, certainly the first 4 needs are going to attract only a small group of less-discerning people. Even the first 5 needs will only capture the group of users with exactly those 5 needs or fewer. But by the time you're reaching the end of the to-do list, every new need is unlocking a big group of almost-satisfied users.

(This part is coool because it explains what startups so often experience: at first, fulfilling needs for your target market creates a small jump in absolute user count. But through this "AND" effect, each subsequent need you fulfill can create a bigger and bigger jump. Even if the new features seem fairly small or relatively easy compared to your early work!)

Comparing strategies

Of course, that was a single simulation based on a bunch of made-up arbitrary assumptions and some numerical constants selected mainly on the basis of how pretty the graph would look.

The good part comes when we compare multiple product management strategies:

Let's continue to assume a fixed market segment of 10,000 users, each of whom have an assortment of wants and needs.

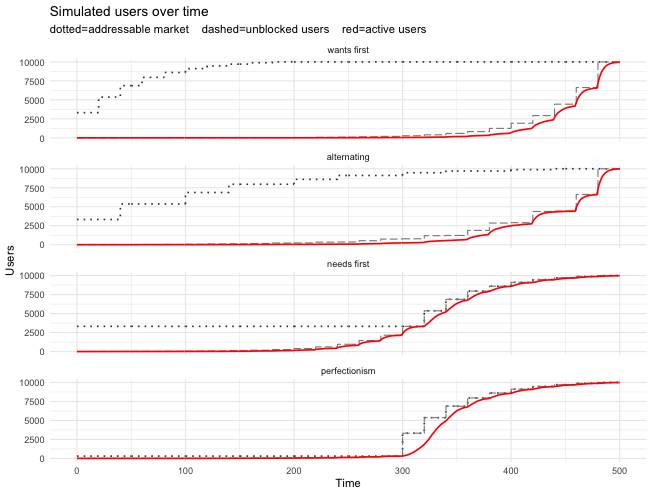

The four plots above correspond to four ways of prioritizing those wants and needs:

-

Features First: the "maximum hype" approach. Implement all 10 wants before solving any needs at all. This maximizes TAM as early as possible. Some early-stage investors get starry-eyed when they see that, but unfortunately you don't get a lot of live users because although people are excited, they can't actually use the product. This is also what you get if you don't, as Steve Blank would say, "get out of the building" and talk to real customers.

-

Alternating: switch between implementing wants and needs, semi-randomly. It turns out this grows your userbase considerably faster than the first option, for the same reason that you'll do okay at rock-paper-scissors by using a random number generator instead of always choosing rock. The main thing here is shipping those randomly-ordered milestones as fast as you can. As SimSWE 1 and 2 emphasized, if you do that, you can get away with not being super great at prioritization.

-

Needs First: just implement exactly one want, then fix all the needs before moving on to other wants. This is a purified Crossing the Chasm model. You can see that the TAM doesn't start increasing until pretty late, because new use cases are on hold. But we get precious real users earlier, which spread word-of-mouth sooner and lead to faster exponential adoption later.

-

Perfectionism: the naive opposite of features-first; a variant of needs-first where we don't even solve a single want before we start trying to address needs. Since the product does nothing useful, but very reliably, nobody wants to buy it at first (~zero TAM). When we finally start launching use cases, we can add them pretty quickly, but actual growth lags behind, at first, because we were late in getting our exponential growth curve started. think of this as the "we got SOC2 compliance before we had any customers" strategy.

In these plots, the important things to look for are getting more users sooner (money in the bank!) and total area under the curve (aggregate value delivered). Users you get earlier are users who give you money and spread word-of-mouth over a longer time, so they are much more valuable than users you add later.

In this version of the plot, it looks like #3 is winning, #4 is not too bad, and even #2 might be kind of okay. In the end, is there really much difference?

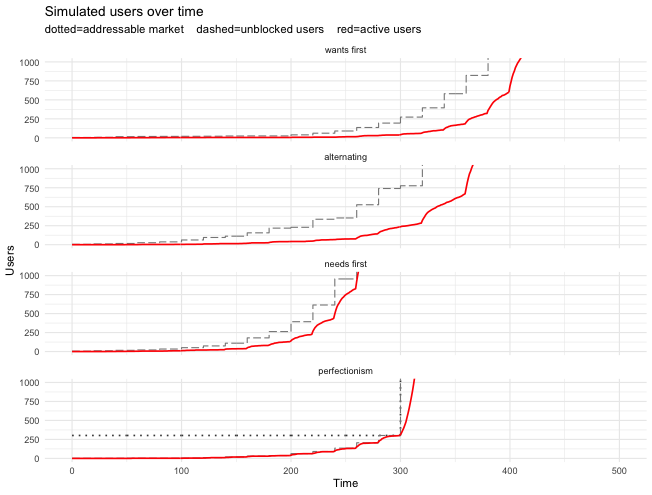

Let's zoom in!

More needs fulfilled, more momentum

This plot zooms the y axis to the first 1000 customers, leaving the x axis unchanged from before. Now the differences are more dramatic.

Here you can see that needs-first starts attracting at least a noticeable number of live customers at time 150 or so. The others take much longer to get rolling.

This feels intuitively right: in the early days of a startup, you build an

MVP, nobody uses it, you find a few willing suckers early

adopters and listen to their feedback, fix the first couple of roadblocks,

and now you have a few happy niche users. If all goes well, those users

will refer you to more users with a few more roadblocks, and so on. At that

stage, it's way too early to worry about expanding your TAM.

What I find exciting - but not all that surprising, having now immersed ourselves in the math - is that the needs-first approach turns out to not be a compromise. The word-of-mouth advantage from having zero-roadblock, excited, active users early on means the slow part of the exponential growth can get started early, which over time makes all the other effects look small. And each successive fulfilled need unlocks an ever-greater number of users.

In contrast, you can see how increasing the TAM early on has not much benefit. It might get your investors excited, but if you don't have live users, there is nobody to spread word-of-mouth yet. Surprisingly little is lost by just focusing on one small want, clearing out roadblocks for people who want that, and worrying about the rest later.

Why would you follow me on twitter? Use RSS.